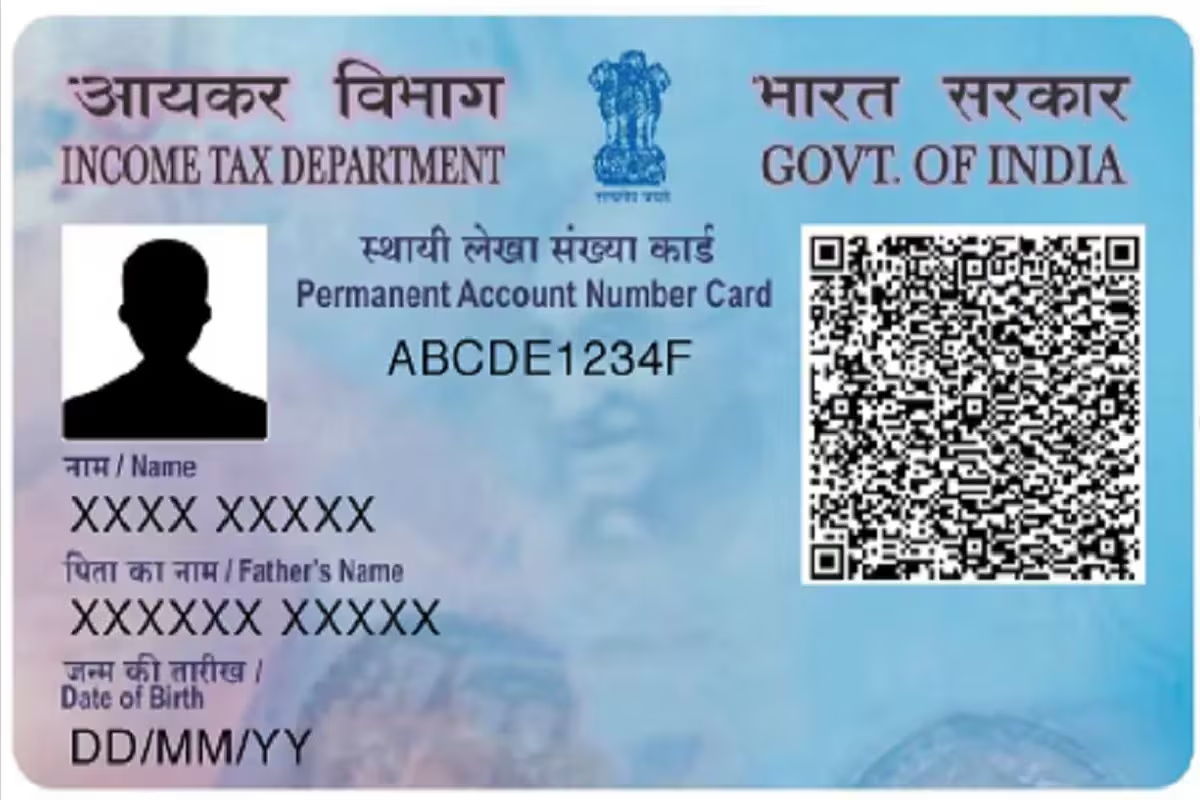

The Permanent Account Number (PAN) has undergone significant modernization with the introduction of PAN 2.0, part of the Indian government’s broader initiative to streamline tax systems and enhance digital security. Here’s everything you need to know about the latest updates to PAN cards, including key features and implications for taxpayers and businesses:

What is PAN 2.0?

The PAN 2.0 project, approved by the Cabinet Committee on Economic Affairs with an investment of ₹1,435 crores, introduces advanced digital features. It aims to simplify taxpayer registration and improve the efficiency of compliance processes.

Key highlights of PAN 2.0 include:

- Dynamic QR Code: New PAN cards will feature QR codes containing updated information for quick digital verification. Scanning the QR code will instantly display the cardholder’s details, enhancing usability.

- Unified Portal: PAN and TAN services, including updates and corrections, are now consolidated into a single platform to reduce delays and streamline processes【6】【7】.

Are Old PAN Cards Still Valid?

Yes, existing PAN cards remain valid under the PAN 2.0 system. Taxpayers are not required to apply for a new card unless they want to benefit from the upgraded features such as the QR code. Corrections or updates can still be made to the existing cards via Aadhaar-linked online services【7】【8】.

Key Benefits for Individuals

- Simplified KYC: The integrated QR code facilitates faster and more secure Know Your Customer (KYC) processes.

- No Additional Cost: The upgrade to PAN 2.0 features is free, ensuring no financial burden for taxpayers.

- Data Accuracy: Improved mechanisms ensure higher accuracy in taxpayer details, reducing errors in compliance【6】【7】.

Benefits for Businesses

Businesses stand to gain significant advantages from PAN 2.0:

- Universal Identifier: PAN will serve as a unified identifier for multiple government agencies, potentially replacing other registration numbers like GSTIN and TAN.

- Streamlined Compliance: Enhanced technology frameworks reduce administrative burdens, making compliance more straightforward for businesses【6】【7】.

How to Upgrade or Update PAN Details

- Visit the NSDL PAN Services or UTI PAN Services portals to make corrections or apply for updates.

- QR-code-enabled PAN cards can be requested, but this is optional and does not affect the validity of existing PAN cards【8】.

Future Implications

The PAN 2.0 initiative is expected to bolster India’s digital governance framework, making tax processes more accessible and secure. With over 780 million PAN holders, the project is set to benefit both individuals and businesses, aligning with the government’s vision for a unified and efficient tax ecosystem【6】【8】.

Internal Link :- ragdi