The PAN Card Status Online or PAN, is an essential identification document for Indian citizens, especially when it comes to financial and tax-related transactions. Whether you have applied for a new PAN card or requested an update, tracking its status is an easy process. This guide will walk you through all the essential details about PAN card status, how to check it online, and answer some frequently asked questions.

A PAN card is a 10-character alpha-numberic identification issued by the Income Tax Department of India. This allows linking all your financial transactions for proper governmental scrutiny to prevent tax evasion and simplifies the taxation process. The procedure from filing income tax returns to opening a bank account depends on the availability of the PAN card, and in every way, it’s an inevitable document for both residents and non-resident Indians.

PAN Card Status Online

Checking your PAN card status keeps you updated on the status of your application. It keeps you informed about any delay or problem so that it can be sorted out in time. The status tracking is particularly essential if you are waiting for the card for some urgent financial or legal issues.

Methods to Check PAN Card Status Online

The Income Tax Department provides several online tools to check the status of your PAN card application. Here are the most popular methods:

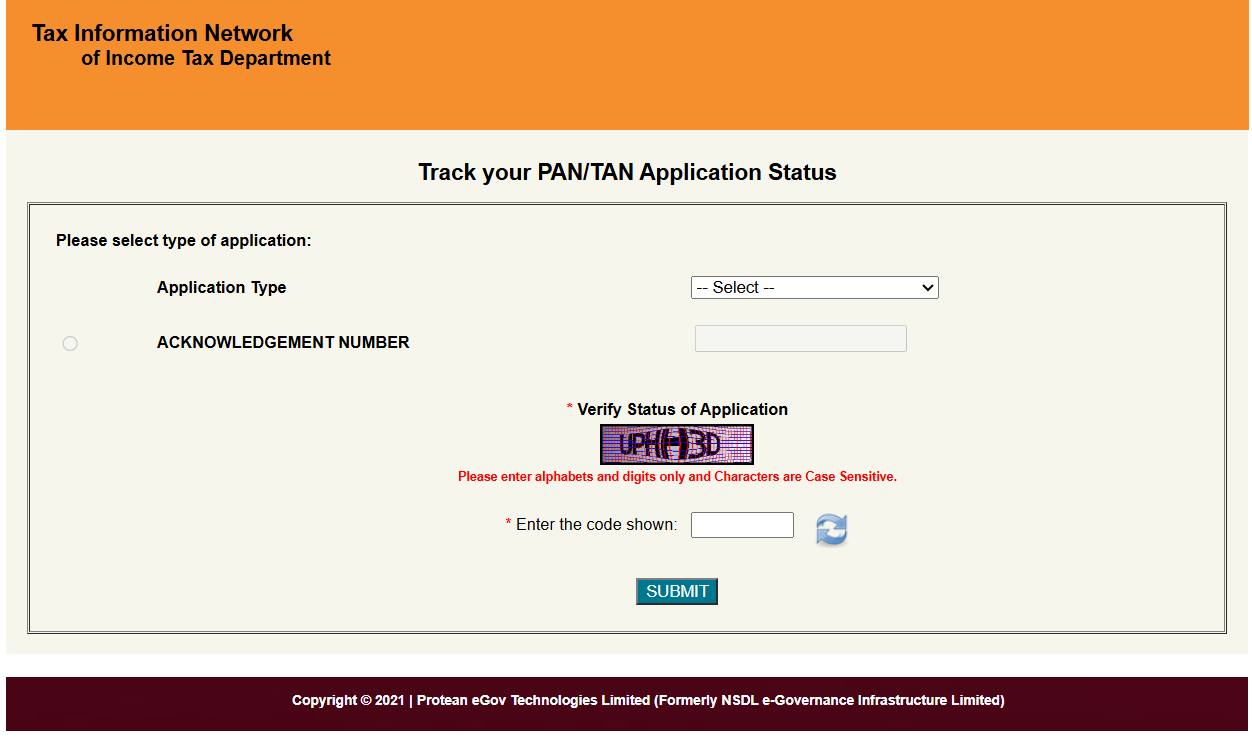

1. Through NSDL’s Official Website

The National Securities Depository Limited (NSDL) handles PAN card applications and provides an easy way to track your application status.

Steps to Check Status on NSDL:

Visit the NSDL e-Gov website: https://tin.tin.nsdl.com/pantan/StatusTrack.html.

Choose the “Application Type” (e.g., New PAN or Correction/Update).

Enter your acknowledgment number (you should receive this when you applied).

Now fill in the CAPTCHA code and hit “Submit.”

Your PAN card status should appear on the screen.

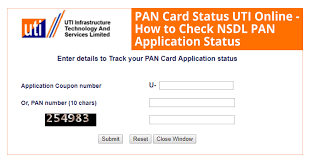

2. Through UTIITSL’s Portal

UTI Infrastructure Technology and Services Limited, also known as UTIITSL, is another authorized body from which to apply for your PAN card. This is how you can follow through with the status check process:

Steps to Check Status at UTIITSL

Type in the UTIITSL PAN status page: https://www.pan.utiitsl.com/PANONLINE/.

Enter your PAN application coupon number or PAN number.

Click “Submit” to view the current status.

3. From the Portal of Income Tax Department

You can also check the status of your PAN application directly from the website of the Income Tax Department.

Steps:

Visit the e-filing portal of Income Tax: https://www.incometaxindiaefiling.gov.in.

Go to the PAN section and click on “Know Your PAN/TAN/AO” or an option with a similar name.

Enter your name, date of birth, and acknowledgment number.

The status of your PAN card application will be displayed.

The Most Common PAN Card Status Results and Interpretations

Under Process: Your application still is under the scrutiny of the administrative authorities.

Dispatched: Your Pan card has been sent out to the address you give.

Delivered: the pan card has been delivered to the address you gave.

Marked Objection: A problem has been identified by the administration with your form, such as incomplete information or insufficient documents.

How Long Does It Take to Get a PAN Card?

In general, it takes around 15-20 working days from the date of application for a PAN card to be issued. However, sometimes delays may occur on account of verification issues in documents or heavy volumes of applications.

Frequently Asked Questions (FAQs)

1. What if my PAN card is not delivered?

If your PAN card status shows “Dispatched” but you haven’t received it, contact the courier service mentioned in the tracking details. Alternatively, reach out to the NSDL or UTIITSL customer service for assistance.

2. Can I Check PAN Card Status Without an Acknowledgment Number?

Yes, you can track the status using your name and date of birth through the respective portals.

3. What Does ‘Objection Marked’ Mean in PAN Card Status?

This simply means that there is something that has gone wrong with your application, be it missing documents or discrepancy in the information submitted, and it should be sorted by following the instructions on the portal.

4. Can I Download My e-PAN Card When the Physical Card is still to Arrive?

Yes. Once your PAN application gets processed, you can download your electronic version (e-PAN) from the NSDL or UTIITSL portal.

Tips to Avoid Delayed Processing of PAN Card

All information contained in the application form must be cross-checked.

All documents to be submitted should be clear and valid.

The verification process raises objections and queries that you must promptly respond to.

Conclusion

Tracking your PAN card status online, you can do it easily and quickly due to the various tools provided by NSDL, UTIITSL, and the Income Tax Department. This way, once you are updated, then you can address any potential issues accordingly and get your PAN card without unnecessary delays. Never forget that a PAN card is more than just an ID; it’s your gateway to financial security and compliance in India. So, therefore, keep this guide handy and track your PAN status effortlessly!

Internal link :- ragdi